Nobody enjoys paying bills, but it’s something that has to be done. There are some things that most of us simply don’t want to live without, and those things have to be paid for.

Utilities

Utilities refer to all the main bills that we have to pay to keep the home warm and functioning. So, that includes water, electricity and gas. Most households in the UK will pay between £75 and £125 per month for their utilities. If you want to save some money on these bills, then you should compare the different offers from different providers. This is now very simple thanks to all the online comparison sites.

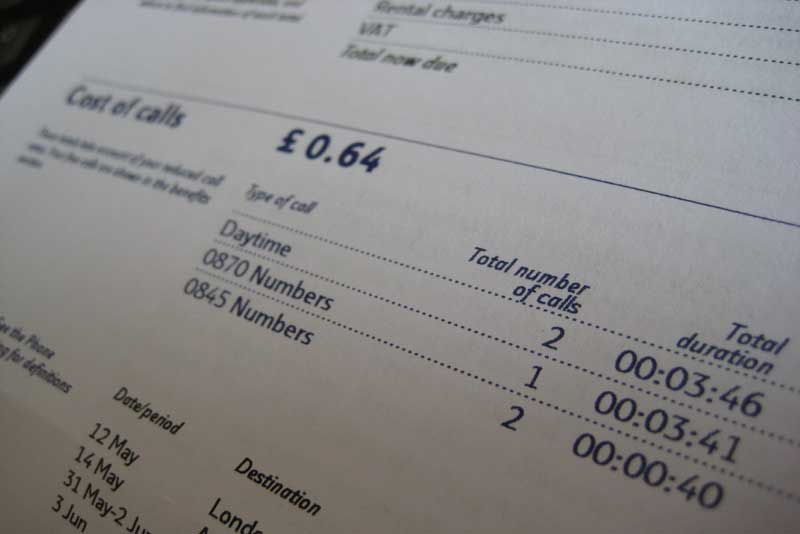

Phone and Broadband

Phone and Broadband

These days, your phone and broadband bills can be combined in one package. This saves you some money, and you can even have a TV package bundled in as well. We all want to get the best internet connection speeds though, so compare the different options before coming to a decision. Paying less might not be worth it if it takes forever for your websites to load. It’s all about getting value for your money.

Council Tax

Usually, the biggest monthly repayment for a household is council tax. Every local authority in the country sets its council tax rates. The amount you pay will, therefore, depend on where you live and what kind of property you live in. They are charged in different bands. So, people living in a more valuable home will mean that you are charged more in council tax by the local authority. If you want to cut your council tax, you need to move into a more model home.

Mortgage

Most people have a mortgage that they spend decades paying back. These payments will obviously vary from person to person. But the average monthly mortgage repayment for a couple who both work full time comes to about £780. That’s no small sum of money, so this will eat into your overall income at the end of the month. Also taking into account that getting a suitable mortgage is tough, to begin with, especially for those with bad credit history. If you have bad credit and you need a mortgage, we may be able to help here. It’s still often cheaper and better in the long term than paying rent to a landlord though.

Insurance

If you own your own home, then you really need to make sure that you have the right insurance to keep you covered. The building insurance will protect the actual structure of your home if anything happens to it. And then there is home contents insurance. This is different because it covers the possessions that you have in your home. All in all, most people only pay about £40 each month on home and contents insurance.

Other Costs

There are plenty of other small costs that you will also need to take into account. For example, there is a TV licence that you will need to pay for if you watch any television. Then there are the costs associated with transportation. This might involve paying for your car’s fuel and maintenance. And public transport doesn’t exactly come cheap either. Everyone has to take care of these other extra costs from month to month.

DISCLAIMER: These articles are for information only and should not be construed as advice. You should always seek advice prior to taking any action.

Phone and Broadband

Phone and Broadband